1. Introduction: The Genesis and Core Principles of Bitcoin

2. Bitcoin’s Practical Limitations: The Great Divergence

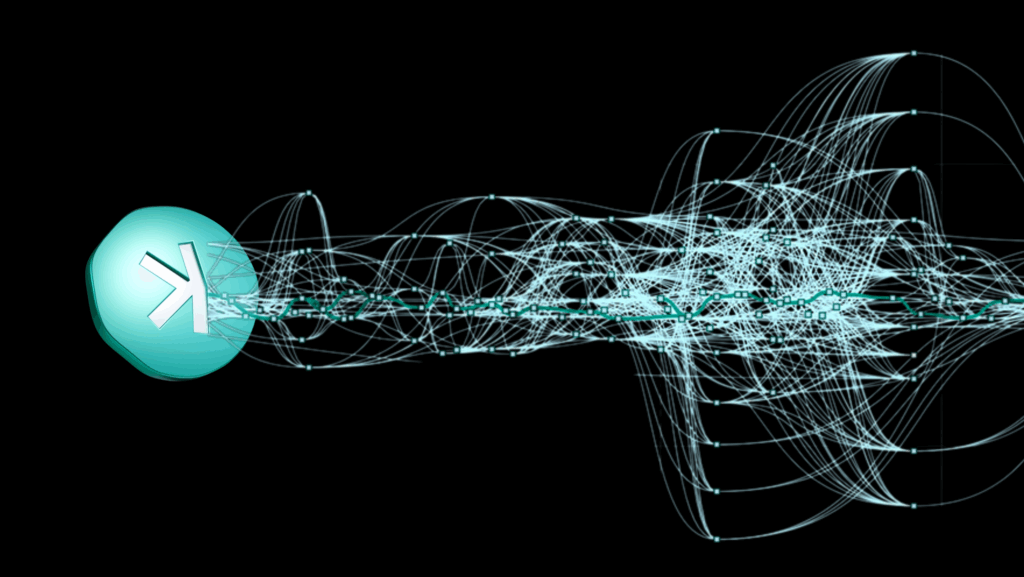

3. From Chain to Graph: The Evolution of Scalable PoW

-

BlockDAG foundation: Miners reference all current tips on new blocks—those without kids—tying to several ancestors, forming a tight web. Thus, no honest block wastes: concurrent mines blend, each adding security via built work.

-

k parameter controls parallelism: it limits blue blocks in a block’s anticone—the non-related set. This tunes for network variance; higher k handles more simultaneity. Kaspa’s upgrades support 10 per second.

-

Nodes perform greedy division: blocks blue (firmly embedded) or red (loosely tied). From genesis, follow heaviest path by picking successors with largest blue past, making a main spine. Add others to blue if anticone meets k; breaches go red, marking lags or threats.

-

Final ordering: sort blue topologically—a DAG norm—then slot red deterministically. This gives universal transaction order, nodes using it for conflict resolution like double-spends.

4. Comparative Analysis: Performance Benefits

-

Throughput: Bitcoin’s 3–7 transactions per second suits low volume but chokes on demand; Kaspa’s multi-thousands at 10 per second handles global scale effortlessly.

-

Confirmation time: Bitcoin’s hour for safety fits stores but not retail; Kaspa’s 10 seconds enables instant use, like cash.

-

Fees: Bitcoin spikes over $50 in busy times, killing micros; Kaspa’s plentiful space keeps under a penny, reviving low-cost.

-

Mining decentralization: Bitcoin’s variance drives pools, centralizing; Kaspa’s rapidity cuts variance, viable solos decentralize.

5. Critical Perspective: Expanded Critiques & Risks

-

Selfish Mining 2.0. With fast blocks, an attacker controlling ≳25 % hash could attempt DAG-aware withholding strategies that exploit GHOSTDAG’s anticone metrics rather than chain length.

-

Fee-Sniping & Transaction Forward-Running. Low fees limit the upside, but bots could still reorder high-value transactions during congestion micro-bursts.

-

Long-Range Nothing-at-Stake. Less of an issue in PoW, yet the DAG’s inclusive nature demands careful fork‐choice logic to reject energy-free historical rewrites.

6. Conclusion